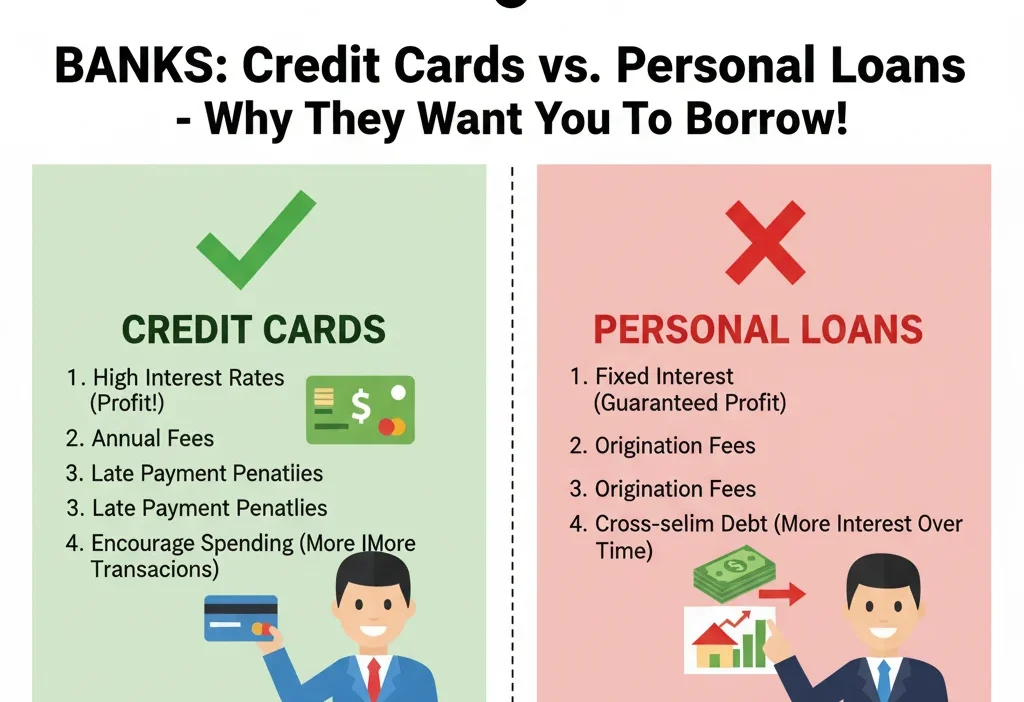

Why do you think banks will try to sell you credit cards or personal loans?

The main reason is simple: these two products help banks earn money — but they also confuse many people. Even adults mix them up because both involve borrowing money, paying interest, and returning it later. But in reality, credit cards and personal loans are very different, just like two similar-looking tools that do completely different jobs.

In this easy guide, you will learn the meaning, difference, and correct usage of credit cards vs personal loans. Every explanation is simple, friendly, and clear enough for even a class 4 student to understand. You’ll also see examples, short stories, memory hacks, and a comparison table.

By the end, you will know exactly when to use a credit card and when to take a personal loan—and why banks try to sell both.

What Does Each Word Mean? (Simple Definitions)

Even though our focus keyword is “why do you think banks will try to sell you credit cards or personal loans,” we first need to understand the meaning of both phrases.

1. What Is a Credit Card? (Simple Meaning)

A credit card is a small plastic card that lets you borrow money again and again, up to a limit.

It is flexible, reusable, and great for small daily expenses.

Part of Speech: Noun (a thing)

Simple Examples:

- “I used my credit card to buy snacks.”

- “My credit card bill is due next week.”

- “The bank increased my credit card limit.”

Mini-Story to Remember:

Think of a credit card like a reusable water bottle. You can fill it again and again as long as you empty it (pay the bill).

2. What Is a Personal Loan? (Simple Meaning)

A personal loan is money the bank gives you all at once, and you must pay it back in fixed monthly amounts.

It is great for big expenses, emergencies, or planned purchases.

Part of Speech: Noun (a thing)

Simple Examples:

- “I took a personal loan to pay my college fee.”

- “The personal loan must be repaid in 24 months.”

- “The bank approved my personal loan quickly.”

Mini-Story to Remember:

Think of a personal loan like a bucket of water. You get all of it at the same time, and you must return it slowly every month.

The Key Difference Between Credit Cards and Personal Loans

Here’s the simplest explanation:

- A credit card is for small, repeated spending.

- A personal loan is for big, one-time expenses.

Comparison Table: Credit Cards vs Personal Loans

| Feature | Credit Card | Personal Loan |

|---|---|---|

| Type of Borrowing | Borrow small amounts again and again | Borrow one large amount once |

| Repayment | Flexible (you can pay minimum amount) | Fixed monthly installments |

| Interest Rate | Usually higher | Usually lower |

| Best For | Shopping, food, emergencies, travel | Medical bills, education, home repair |

| Example Sentence | “I used my credit card for groceries.” | “I used a personal loan for surgery.” |

Quick Tip to Remember

- Credit card = like a tap (you open it anytime and use a little water).

- Personal loan = like a tank (you get all the water at once).

Common Mistakes and How to Avoid Them

Mistake 1: Using a credit card for huge expenses

❌ Wrong: “I will buy a car with my credit card.”

✔️ Correct: “I will take a personal loan to buy a car.”

Why? Credit card interest is very high for large purchases.

Mistake 2: Taking a personal loan for daily small expenses

❌ Wrong: “I took a personal loan to buy snacks every week.”

✔️ Correct: “I used my credit card for weekly snacks.”

Why? Personal loans are for big, planned needs.

Mistake 3: Thinking both are the same

❌ Wrong: “A credit card and personal loan work the same.”

✔️ Correct: “They are different tools for different needs.”

When to Use a Credit Card

Credit cards are best for small, short-term expenses. You borrow only what you need.

Use a credit card when:

- You want to buy groceries.

- You need to pay for fuel.

- You want to shop online.

- You are traveling and need flexibility.

- You want reward points or cashback.

Example Sentences:

- “I used my credit card to buy a book online.”

- “My credit card helped me during travel.”

- “I paid my electricity bill through my credit card.”

Memory Hack:

Credit Card = Quick Card

Use it for quick, small purchases.

When to Use a Personal Loan

Personal loans are perfect for big, important expenses where you need more money at once.

Use a personal loan when:

- You need to pay for medical treatment.

- You want to renovate your home.

- You need to pay school or university fees.

- You want to start a small business.

- You must handle an emergency.

Example Sentences:

- “I took a personal loan to fix my roof.”

- “The personal loan helped me pay medical bills.”

- “I used a personal loan to start my shop.”

Memory Hack:

Personal Loan = Big Loan

Use it when the need is big.

Is a Student Loan Secured or Unsecured? The Hidden Truth 2025

Quick Recap: Credit Cards vs Personal Loans

- Credit Card: Small, repeated spending. Flexible payments. Higher interest.

- Personal Loan: Big, one-time money. Fixed payments. Lower interest.

- Use a credit card for daily needs.

- Use a personal loan for large expenses.

- Banks sell both because they earn interest and fees.

Advanced Tips (Optional)

- History: Credit cards became popular in the 1950s; personal loans are much older.

- In formal writing: Use “credit card” for revolving credit and “personal loan” for fixed-term borrowing.

- In online writing: Mixing these terms can confuse the reader because each has a specific purpose.

- Impact of misuse: Using the wrong product can increase debt and cause financial stress.

Mini Quiz: Test Yourself

Choose credit card or personal loan:

- “I want to buy a laptop. I need a ______.”

- “I need to buy groceries today. I will use my ______.”

- “My house roof is damaged. I must take a ______.”

- “I bought clothes online using my ______.”

- “The hospital bill was large, so I took a ______.”

- “I want reward points, so I used my ______.”

- “I need all the money at once, so I applied for a ______.”

5 FAQs

1. Why do banks try to sell you credit cards or personal loans?

Because these products help banks earn money through interest and fees.

2. What is the difference between a credit card and a personal loan?

A credit card offers small, repeated borrowing; a personal loan gives one big amount.

3. Which is better: a credit card or a personal loan?

Neither is better — the right choice depends on your need.

4. Is a credit card good for emergencies?

Yes, it is helpful for small or immediate expenses.

5. Can I use a personal loan for shopping?

You can, but it is not recommended. Credit cards work better for shopping.

Conclusion

Now you understand why banks try to sell you credit cards or personal loans. Both help people borrow money, but they work in very different ways. Credit cards are great for small, everyday expenses, while personal loans are useful for big, important needs. Choosing the right one can save you money and make your financial life easier.

The next time someone asks, “Why do you think banks will try to sell you credit cards or personal loans?” you will be able to explain it clearly.

Keep practicing, keep learning, and you’ll become smarter with money every day.

Henry Vale is a tech-savvy content creator at WordContrast.com, known for his in-depth guides and how-to articles. With a background in digital media and a passion for innovation, Henry focuses on simplifying technology for everyday users. His mission is to empower readers with clear, actionable knowledge they can use to improve their digital lives.