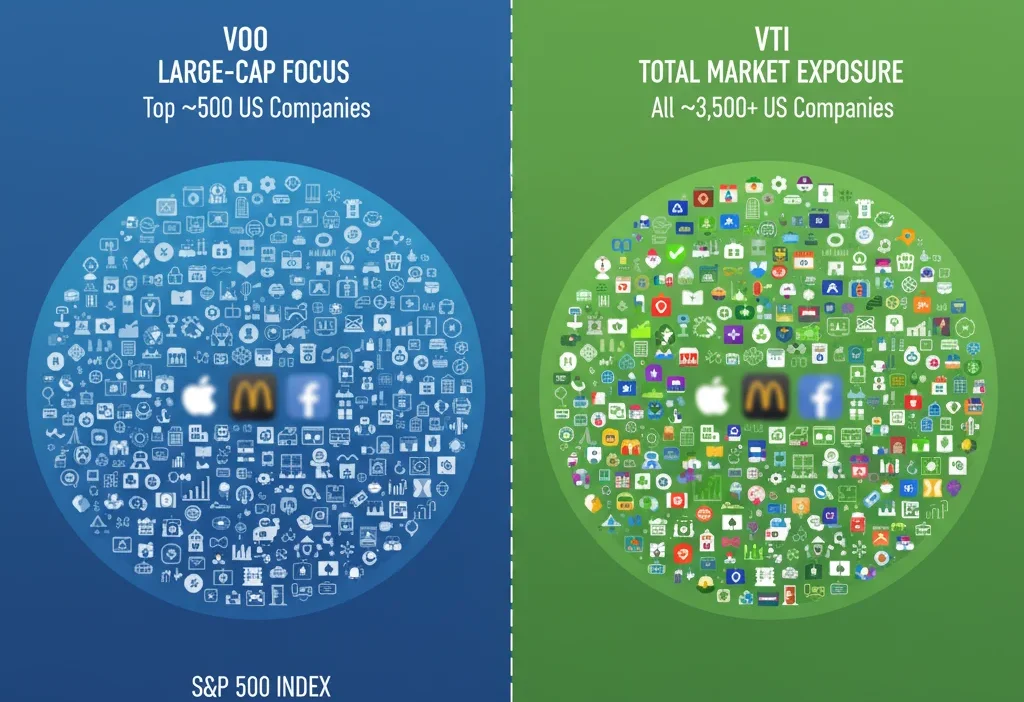

“VOO or VTI” confuses many beginners because both are popular U.S. stock market ETFs from Vanguard. The simple difference: VOO tracks only large-cap S&P 500 companies, while VTI covers the entire U.S. stock market — large, mid, and small cap.

Many beginners get confused when choosing VOO or VTI because both are famous ETFs created by Vanguard. The names look similar and both help people invest in the U.S. stock market. But even though the tickers look almost the same, they represent two different types of investments.

This guide explains what VOO means, what VTI means, the difference between the two, and when to use each one. Everything is written in very simple English so even a class 4 student can understand. You will learn meanings, examples, common mistakes, a comparison table, memory tricks, and a quick summary.

By the end, you will know exactly how to choose VOO or VTI easily and confidently — without any confusion.

What Does Each Word Mean? (VOO and VTI Explained Simply)

Even though they look like English words, VOO and VTI are not vocabulary words. They are ticker symbols — short codes used in the stock market.

Let’s explain them in the simplest way possible.

⭐ What Does VOO Mean?

VOO = Vanguard S&P 500 ETF

- Tracks the top 500 big companies in the U.S.

- Only large-cap stocks

- Think of VOO as the “big companies club.”

3 Easy Examples

- “I bought VOO because I want to invest in big companies only.”

- “VOO includes brands like Apple, Amazon, and Microsoft.”

- “If you want stability, VOO is a common choice.”

⭐ What Does VTI Mean?

VTI = Vanguard Total Stock Market ETF

- Tracks the entire U.S. stock market

- Includes large, mid, and small companies

- Think of VTI as “all companies in one basket.”

3 Easy Examples

- “I chose VTI because it covers the whole market.”

- “VTI includes thousands of companies, not just the big ones.”

- “If you want full market exposure, VTI fits well.”

The Key Difference Between VOO and VTI

Here’s the simplest way to understand it:

VOO = Only big companies.

VTI = All companies.

✔️ Comparison Table

| Feature | VOO | VTI |

|---|---|---|

| Tracks | S&P 500 (only big companies) | Total U.S. Market (big + small) |

| Number of Companies | ~500 | 4,000+ |

| Risk Level | Lower | Slightly higher |

| Growth Potential | Moderate | Higher (long term) |

| Best For | Stability | Complete market exposure |

| Example Use | “I want strong, famous companies.” | “I want variety across all sizes.” |

⭐ Quick Tip to Remember

VOO = Very Outstanding (Big) Only

VTI = Very Total Investment

Common Mistakes and How to Avoid Them

❌ Mistake 1: Thinking VOO and VTI are the same

✔️ Fix: Remember that VOO = 500 companies; VTI = thousands.

❌ Mistake 2: Believing VTI is “safer”

✔️ Fix: VTI has small companies which can be more risky.

❌ Mistake 3: Using VOO when you really want full diversification

✔️ Fix: For maximum variety, VTI is the correct choice.

When to Use VOO

Use VOO when:

- You want only large, stable companies

- You prefer lower risk

- You want simple market exposure

- You are investing for long-term safety

⭐ Example Sentences

- “I picked VOO for steady, big-company growth.”

- “My teacher told me VOO is simple for beginners.”

- “I like investing in famous brands, so I chose VOO.”

- “VOO helps me avoid small-company risk.”

- “If I want stability, VOO makes sense.”

When to Use VTI

Use VTI when:

- You want full market exposure

- You prefer variety (big + small companies)

- You’re okay with slightly more risk

- You want long-term growth potential

⭐ Example Sentences

- “I chose VTI to invest in the entire market.”

- “VTI gives me more variety than VOO.”

- “For long-term growth, VTI is a good option.”

- “Small companies in VTI may grow fast.”

- “I prefer diversification, so I selected VTI.”

⭐ Memory Hack

T in VTI stands for Total — Total market.

Quick Recap: VOO vs VTI

- VOO = Big companies only

- VTI = All companies

- VOO = Lower risk

- VTI = Higher diversification

- VOO = Better for stability

- VTI = Better for full-market growth

Advanced Tips (Optional Section)

- VOO is tied to the S&P 500 index, which is widely used in exams and financial studies.

- VTI includes thousands of stocks, making it useful for teaching index fund concepts.

- In formal writing or essays, you can describe VOO as a “large-cap ETF” and VTI as a “total-market ETF.”

- Beginners often misuse these terms online because the names look similar. This guide helps avoid that confusion.

Mini Quiz (Test Yourself)

Fill in the blanks:

- ______ covers only large companies.

- ______ includes the whole U.S. stock market.

- If you want diversification, choose ______.

- For more stability, ______ might be better.

- The ticker for the S&P 500 ETF is ______.

(Answers: 1. VOO 2. VTI 3. VTI 4. VOO 5. VOO)

5 FAQs

1. What is the main difference between VOO and VTI?

VOO tracks big companies; VTI tracks the entire market.

2. Which is better, VOO or VTI?

It depends. VOO is stable; VTI is more diversified.

3. Is VTI riskier than VOO?

Slightly, because it includes small companies.

4. Can I invest in both VOO and VTI?

Yes, many people do.

5. Which one is better for beginners?

Both are simple, but VOO is often easier to understand.

Conclusion

Choosing between VOO or VTI becomes easy when you understand the basic difference: VOO focuses only on big companies, while VTI covers the entire U.S. market. Both are strong, beginner-friendly options, and both help you grow your money over time.

If you want more stability, VOO is a simple choice. If you want more variety and higher long-term potential, VTI is a great option. Keep practicing, read examples again, and you will quickly become confident in choosing the right ticker.

Learning small differences like these helps you improve your financial knowledge every day.

Henry Vale is a tech-savvy content creator at WordContrast.com, known for his in-depth guides and how-to articles. With a background in digital media and a passion for innovation, Henry focuses on simplifying technology for everyday users. His mission is to empower readers with clear, actionable knowledge they can use to improve their digital lives.