People often ask, “Is a student loan secured or unsecured?” These two terms — secured and unsecured — confuse many students, parents, and even adults who already finished school. Both words look simple, but their meanings are very different. And understanding them is important because it affects safety, risk, and how lenders trust you.

In this friendly guide, you will learn the meaning of secured vs unsecured, how student loans fit into these categories, and how to remember the difference easily. Every section uses simple English, real-life examples, and short explanations so even a 4th-grade student can understand.

By the end, you will confidently know whether student loans are secured or unsecured — and why that matters.

What Does “Secured” Mean? (Simple Explanation)

A secured loan is a type of loan that needs something valuable as collateral.

Collateral means an item the bank can take if you don’t pay back the loan.

Examples of collateral:

- A house

- A car

- Land

- Jewelry

If you don’t pay, the bank takes the item. That’s why it’s called secured — the bank feels “safe.”

3 Simple Examples of Secured Loans

- You get a car loan using your car as collateral.

- You buy a house using the house as collateral.

- You borrow money using gold or jewelry as security.

What Does “Unsecured” Mean? (Simple Explanation)

An unsecured loan does not need any collateral. The bank trusts your credit history, income, or your promise to pay.

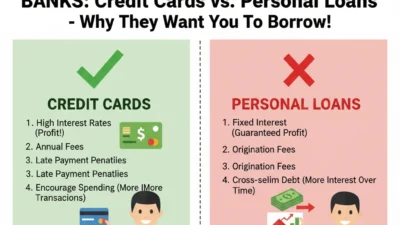

Examples of unsecured loans:

- Credit cards

- Personal loans

- Most student loans

If you don’t pay, the bank cannot take your house or car. They can only charge fees, report late payments, or take legal steps.

3 Simple Examples of Unsecured Loans

- You borrow money to buy a laptop without giving any item as security.

- You use a credit card to pay for books.

- You take an education loan that doesn’t need collateral.

🔍 So, Is a Student Loan Secured or Unsecured?

Most student loans are unsecured.

This means you do not need a house, car, or any valuable item as collateral. The lender gives you money based on your education need, family income, and trust.

Some private lenders may offer secured student loans, but only if you use property or valuable items as collateral. These are less common.

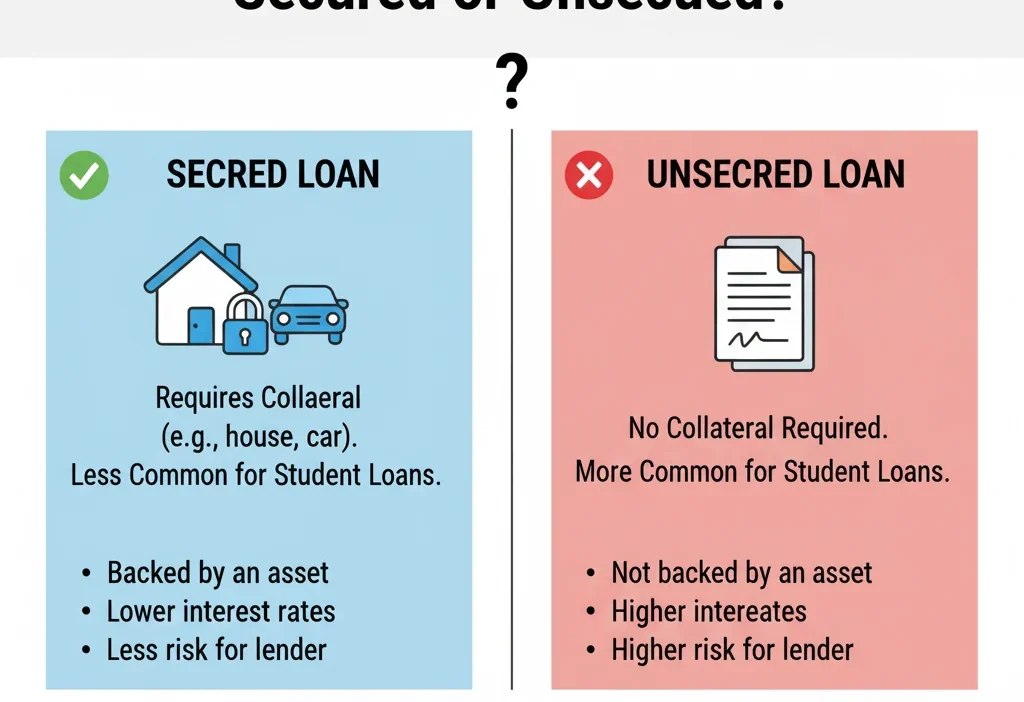

The Key Difference Between Secured and Unsecured Student Loans

Comparison Table

| Feature | Secured Student Loan | Unsecured Student Loan (Most Common) |

|---|---|---|

| Collateral Needed | Yes | No |

| Risk for Borrower | High (may lose asset) | Low |

| Interest Rate | Lower | Higher |

| Approval Based On | Value of collateral | Income, need, trust |

| Example | Loan using house as security | Normal student loan |

Quick Tip to Remember

- Secured = Something is at risk (house, car, gold).

- Unsecured = Nothing to lose except your credit score.

Are Alligators or Crocodiles More Dangerous? Real Danger 2025

Common Mistakes and How to Avoid Them

❌ Mistake #1: Thinking all student loans are secured

Correct: Most are unsecured because students usually don’t own houses or cars.

❌ Mistake #2: Confusing “secured loan” with “safe loan”

Correct: Secured means secured for the bank, not the student.

❌ Mistake #3: Thinking “unsecured” means “bad”

Correct: Unsecured simply means no collateral. Many helpful loans are unsecured.

When to Use the Word “Secured”

You use secured when the loan is protected by collateral.

Examples:

- “This loan is secured by my car.”

- “A secured student loan needs property as collateral.”

- “Banks feel safer giving secured loans.”

- “Secured loans usually have lower interest rates.”

- “If you don’t pay a secured loan, you may lose your asset.”

When to Use the Word “Unsecured”

You use unsecured when no collateral is needed.

Examples:

- “Most student loans are unsecured.”

- “An unsecured loan depends on trust and income.”

- “My education loan was unsecured.”

- “Unsecured loans have no risk of losing property.”

- “Banks check credit history for unsecured loans.”

Memory Hack

- Unsecured = Unlocked

Nothing is locked or tied up as collateral.

Quick Recap: Secured vs Unsecured Student Loans

- Secured = needs collateral

- Unsecured = no collateral

- Student loans are usually unsecured

- Secured loans risk losing property

- Unsecured loans rely on trust and income

Advanced Tips (Optional)

- The word secured comes from a root meaning “safe.” But in loans, the bank is the one who feels safe, not the borrower.

- In formal writing, always explain whether a loan is secured or unsecured because it affects risk.

- In online posts or texting, people often use these words incorrectly. Using them correctly makes your message clearer and more professional.

Mini Quiz: Test Yourself!

Fill in the blanks:

- A loan that needs no collateral is called an __________ loan.

- A loan tied to your house is a __________ loan.

- Most student loans are __________.

- A secured loan is safer for the __________.

- An unsecured loan depends on your __________.

(Answers: unsecured, secured, unsecured, bank, credit/ income)

5 FAQs

1. Is a student loan secured or unsecured?

Most student loans are unsecured, meaning they require no collateral.

2. Why are student loans usually unsecured?

Students rarely own property, so lenders rely on income and need instead of collateral.

3. Which is safer for students: secured or unsecured?

Unsecured loans are safer because you cannot lose your house or car.

4. Do secured student loans have lower interest rates?

Yes. Secured loans usually cost less because the bank has collateral.

5. Can I change an unsecured loan into a secured loan?

Some lenders allow it, but it depends on their rules and your assets.

Conclusion

Understanding whether a student loan is secured or unsecured is simple once you know the meaning of both words. Secured loans need collateral, while unsecured loans do not. Most student loans fall into the unsecured category, which makes them safer for students who don’t own property. When you know the difference, you can make better financial choices and avoid common confusion. Keep practicing these terms in everyday reading and writing to feel even more confident. Learning financial words step by step makes your English stronger every day.

Marianne Solace is a lifestyle and personal-growth writer for WordContrast.com. Her work blends inspiration with practicality, offering thoughtful insights on wellness, creativity, and mindful living. When she’s not writing, Marianne enjoys journaling with a cup of coffee, exploring art museums, and helping others find balance through the written word.