Have you ever wondered, “Does car insurance cover the car or the driver?”

You’re not alone — this is one of the most confusing questions about auto insurance. Many people assume their insurance follows them wherever they go, but the truth depends on what kind of coverage you have and who’s driving the car.

In this simple guide, we’ll break down what car insurance actually covers, the difference between car-based and driver-based coverage, and how you can easily remember which applies when. By the end, you’ll understand exactly what happens if someone borrows your car or if you drive someone else’s.

Let’s make this topic easy enough that even a 4th-grader could explain it!

🚘 What Does “Car Insurance” Mean?

Before we dive in, let’s start with the basics.

Car insurance is a type of protection that helps pay for damage or loss involving your vehicle. Think of it like a safety net that catches you when things go wrong — accidents, theft, or injuries.

When people ask, “Does car insurance cover the car or the driver?” the answer usually depends on what type of insurance you’re talking about.

Let’s break it down simply.

🏎️ When Car Insurance Covers the Car

This means the insurance is tied to the vehicle, not the person driving it.

If your car is damaged or stolen, your policy helps repair or replace it — even if someone else was driving (with your permission).

Examples:

- Your car gets hit in a parking lot — your insurance pays for repairs.

- Your friend borrows your car and has a minor accident — your car’s insurance helps cover the cost.

- A tree branch falls on your parked car — your policy pays for the damage.

This is called vehicle-based coverage (like comprehensive or collision insurance).

👨✈️ When Car Insurance Covers the Driver

Sometimes, insurance follows the person, not the car.

This means you’re protected, even if you’re driving a friend’s vehicle (with permission).

Examples:

- You borrow your friend’s car and hit a mailbox — your personal liability insurance may help.

- You rent a car for a trip — your own insurance might still cover you.

- You drive your employer’s car for work — your insurance could apply, depending on your policy.

This is called driver-based coverage, and it’s often part of liability or medical payment protection.

68+Does DoorDash or Uber Eats Pay More? Real 2025 Insights2025

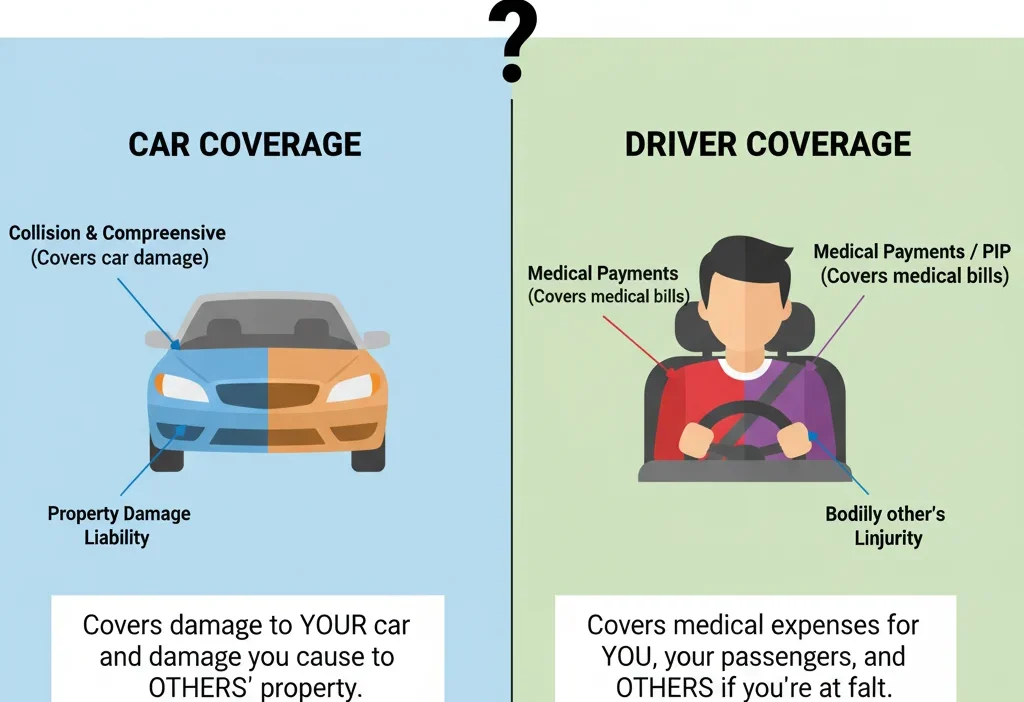

🧾 The Key Difference Between Car and Driver Coverage

Here’s an easy comparison table to help you remember the difference.

| Feature | Car-Based Coverage | Driver-Based Coverage |

|---|---|---|

| Who’s Protected? | The car, no matter who drives it (with permission). | The driver, no matter what car they drive. |

| Common Types | Collision, Comprehensive | Liability, Medical Payments |

| Applies When | The car is damaged, stolen, or vandalized. | The driver causes injury or damage while driving. |

| Example | Your car is hit while parked — your policy pays. | You drive your friend’s car and hit a pole — your insurance may help. |

Quick Tip to Remember:

➡️ If the car gets hurt → it’s car-based.

➡️ If a person gets hurt → it’s driver-based.

🚫 Common Mistakes and How to Avoid Them

Many drivers get confused about who’s covered in different situations. Let’s look at some common mix-ups.

❌ Mistake #1: Thinking car insurance always covers you personally.

✅ Fix: It usually covers the car first, not necessarily every driver.

❌ Mistake #2: Letting a friend drive your car without checking your policy.

✅ Fix: Make sure your insurance includes “permissive use” — meaning others can drive with your permission.

❌ Mistake #3: Assuming you’re covered when driving any car.

✅ Fix: Your insurance might not apply if you’re driving a commercial or non-permitted vehicle.

🚗 When Does Car Insurance Cover the Car?

Your policy typically covers the car when it’s involved in:

- Accidents — repairs or replacements for damage.

- Theft or Vandalism — if your car is stolen or damaged by someone.

- Weather Damage — storms, floods, or falling objects.

- Hitting Animals — like a deer or stray dog on the road.

- Other Drivers Using Your Car (with permission).

Example Sentences:

- My car insurance covered the cost when my car got hit in the parking lot.

- Even though my brother was driving, my insurance paid for the car damage.

- The insurance company repaired my car after a hailstorm.

Memory Trick:

🧠 “If it’s the car that’s hurt, your car’s insurance works first.”

🚙 When Does Car Insurance Cover the Driver?

Driver-based insurance covers the person when they are legally responsible for an accident or injury.

- Liability Coverage — pays for other people’s injuries or property damage.

- Medical Payments — covers your medical bills after an accident.

- Personal Injury Protection (PIP) — helps with hospital and lost wage costs.

- Driving Another Person’s Car — only if your policy allows it.

Example Sentences:

- My insurance covered me when I borrowed my friend’s car and had a small accident.

- The medical payment part of my policy helped with hospital bills.

- Even though I wasn’t driving my own car, my insurance still protected me.

Memory Hack:

🚦“If it’s you who’s responsible, it’s your insurance that steps up.”

🔁 Quick Recap: Car Coverage vs Driver Coverage

✅ Car-Based Coverage

- Protects the car itself.

- Includes collision and comprehensive insurance.

- Covers physical damage to your vehicle.

- Usually applies when others drive your car (with permission).

✅ Driver-Based Coverage

- Protects the person behind the wheel.

- Includes liability and medical coverage.

- Helps pay for others’ injuries or property damage.

- May extend when you drive someone else’s car.

💡 Advanced Tips (For Curious Readers)

- In most U.S. states, car insurance follows the car, not the driver — but it can vary.

- “Permissive use” allows friends or family to drive your car legally under your policy.

- Rental cars: Your personal insurance usually covers them, but always double-check.

- Commercial vehicles: Personal car insurance usually does not apply.

- Driving abroad: You’ll likely need separate international coverage.

Misusing or misunderstanding these can lead to denied claims — always read your policy carefully.

🧩 Mini Quiz: Test Yourself!

Fill in the blanks with car or driver.

- My ______ insurance paid for repairs after my car was hit.

- If you injure someone while driving, your ______ coverage helps.

- A tree fell on my car — my ______ coverage fixed it.

- I borrowed my friend’s car, but my ______ insurance still protected me.

- When the car itself is damaged, ______ insurance applies first.

(Answers: 1. car, 2. driver, 3. car, 4. driver, 5. car)

🏁 Conclusion

So, does car insurance cover the car or the driver?

✅ The simple answer: both — but in different ways.

Car-based coverage protects the vehicle, while driver-based coverage protects the person behind the wheel.

Understanding this difference helps you avoid costly surprises and ensures you’re always protected, whether you’re the owner or just borrowing a ride.

Keep practicing, stay safe, and drive smart — because knowing your coverage is just as important as driving carefully.

❓ 5 FAQs (SEO Optimized)

Q1: Does car insurance follow the car or the driver?

Car insurance usually follows the car, meaning the policy covers the vehicle itself.

Q2: If someone else drives my car, are they covered?

Yes, if they have your permission and your policy includes “permissive use” coverage.

Q3: Does my insurance cover me when I drive someone else’s car?

It might — depending on your liability or driver-based coverage type.

Q4: What kind of insurance covers injuries?

Driver-based coverages like liability, medical payments, or PIP handle injuries.

Q5: Can I drive a rental car using my own insurance?

Usually yes, but check with your insurance company or credit card for confirmation.

Henry Vale is a tech-savvy content creator at WordContrast.com, known for his in-depth guides and how-to articles. With a background in digital media and a passion for innovation, Henry focuses on simplifying technology for everyday users. His mission is to empower readers with clear, actionable knowledge they can use to improve their digital lives.