Many beginners in accounting get confused when trying to understand accounts receivable debit or credit. This is one of the most common questions for students, small-business owners, and new accountants. People mix it up because both debits and credits appear in every transaction, and remembering which one increases or decreases accounts receivable can be tricky.

This simple, friendly guide will help you understand what accounts receivable means, when it is a debit, when it is a credit, and how to use it correctly. We will explain everything with easy terms, short examples, comparison tables, and clear rules. Even a class-4 student will understand the concept by the end.

Let’s make accounting simple and stress-free!

🔍 What Does Accounts Receivable Mean?

Accounts Receivable (AR)

Part of speech/type: Accounting term (Asset)

Simple Meaning:

Accounts receivable is the money your customers owe you because they bought something on credit — meaning they will pay later.

Think of it like lending your friend money. Until they pay you back, the amount they owe is your “accounts receivable.”

3 Easy Examples:

- You sell a book to a customer, and they say, “I will pay next week.”

- A bakery delivers cakes to a restaurant. The restaurant will pay after 10 days.

- A tutor teaches a student and sends the bill after the class.

In all these cases, money is owed to you, so it becomes an asset.

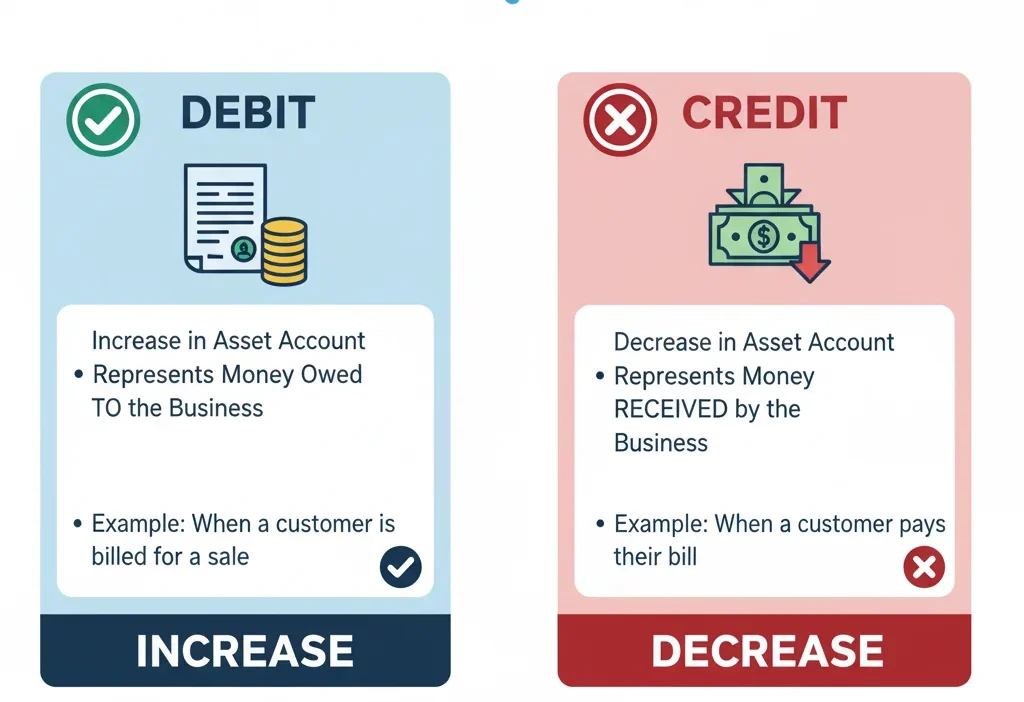

📘 What Do Debit and Credit Mean? (Simple Version)

Debit (Dr):

Increases assets

Decreases liabilities

Credit (Cr):

Decreases assets

Increases liabilities

Memory Trick:

Think of Debit = Plus to what you own.

Think of Credit = Minus to what you own.

🆚 The Key Difference: Accounts Receivable Debit vs Credit

Since accounts receivable is an asset, it follows the asset rule:

- Asset increases → Debit

- Asset decreases → Credit

Here is a simple table:

| Action | What Happens | Debit or Credit? | Example Sentence |

|---|---|---|---|

| Customer owes you more | AR increases | Debit | “We sold on credit today.” |

| Customer pays their bill | AR decreases | Credit | “The customer paid us.” |

| You record a mistake and reverse it | AR decreases | Credit | “We corrected an over-entry.” |

⭐ Quick Tip to Remember:

When customers owe you more, Debit AR. When they pay you, Credit AR.

❌ Common Mistakes and How to Avoid Them

Mistake 1: Crediting AR when a credit sale happens

❌ Wrong:

Credit Accounts Receivable when you sell on credit.

✔ Correct:

Debit Accounts Receivable because the asset increases.

Why?

You are adding to the money people owe you.

Mistake 2: Debiting AR when the customer pays

❌ Wrong:

Debit Accounts Receivable when payment is received.

✔ Correct:

Credit Accounts Receivable because the asset decreases.

Why?

When they pay, the amount owed becomes smaller.

Mistake 3: Mixing AR with Cash

People often treat AR like cash.

But AR is money you will receive later, not now.

📥 When to Use Accounts Receivable as a Debit

Use Debit when your accounts receivable is increasing.

Examples:

- You make a credit sale: Debit AR, Credit Sales

- A customer buys services but will pay in 5 days.

- You send an invoice to a client.

- A customer returns goods, and you reduce their payable amount.

- You mistakenly reduced AR earlier and now need to fix it.

Real-Life Story

Imagine you give your friend a toy and say, “Pay me tomorrow.”

Your friend now owes you money — your asset increases — so you debit it.

Are Alligators or Crocodiles More Dangerous? Real Danger 2025

📤 When to Use Accounts Receivable as a Credit

Use Credit when your accounts receivable is decreasing.

Examples:

- The customer pays their bill.

- The customer returns goods, and you cancel part of their bill.

- You give a discount to the customer.

- You wrote the wrong amount earlier and need to reduce AR.

- You transfer AR to bad debt.

Memory Hack

“If money comes in, AR goes out.”

Meaning:

When customers pay, the amount they owe you goes down — so credit AR.

🔄 Quick Recap: Accounts Receivable Debit or Credit

- Accounts receivable = Asset

- Assets increase with Debit

- Assets decrease with Credit

Easy Rules:

- Credit sale → Debit AR

- Customer pays → Credit AR

- Discount/return → Credit AR

- New invoice → Debit AR

📚 Advanced Tips (Optional)

⭐ Origin

Accounts receivable comes from old bookkeeping systems where traders wrote down who owed them money.

⭐ In Formal Writing

Always write it as Accounts Receivable (AR) in financial reports.

⭐ In Exams

Exams often ask:

“Is Accounts Receivable a Debit or Credit?”

The answer:

Debit (normal balance).

⭐ In Business

Using AR correctly helps you track unpaid bills and keeps your business running smoothly.

🧠 Mini Quiz (Test Yourself!)

Fill in the blanks:

- When you make a credit sale, Accounts Receivable is ______.

- When a customer pays you, Accounts Receivable is ______.

- Accounts receivable is an ______.

- Assets increase on the ______ side.

- Assets decrease on the ______ side.

- Sending an invoice means you should ______ AR.

- Customer return means you should ______ AR.

(Answers: Debit, Credit, Asset, Debit, Credit, Debit, Credit)

❓ FAQs

1. Is Accounts Receivable a debit or credit?

Accounts receivable is normally a debit because it is an asset.

2. Why do we debit AR for credit sales?

Because you have more money owed to you, so the asset increases.

3. When do we credit AR?

When the customer pays, returns goods, gets a discount, or you reduce the amount owed.

4. What type of account is Accounts Receivable?

It is a current asset.

5. What is the normal balance of Accounts Receivable?

The normal balance is Debit

✅ Conclusion

Understanding whether accounts receivable is a debit or credit becomes easy when you remember it is an asset. Assets increase with a debit and decrease with a credit. This simple rule helps you record entries correctly in school assignments, business accounts, or professional accounting work.

By learning the meaning, differences, examples, and common mistakes, you can confidently use accounts receivable without confusion.

Keep practicing with real-life situations, and soon debits and credits will feel natural.

You’re one step closer to mastering accounting!

Oliver Thorne is a passionate digital storyteller and content strategist at WordContrast.com. With years of experience in SEO writing and online marketing, he specializes in transforming complex ideas into clear, engaging articles. Oliver loves exploring the latest trends in technology, productivity, and digital culture—helping readers stay informed and inspired in today’s fast-moving world.